Earnings Optimism

There are three things you should rarely ever bet against: the Leaf’s opposing team in the playoffs, the American consumer’s ability to spend, and corporate profits. As we are now about halfway through U.S. earnings season, once again, positive surprises remain the norm; 81% have beaten. It's a bit better than the 20-year average of 75%. The fact is that companies are good at managing analysts’ expectations. At least enough to beat them when the numbers hit the tape. The size of the positive surprises have been encouraging as well, at just under 10%. The highest surprise magnitude in some time.

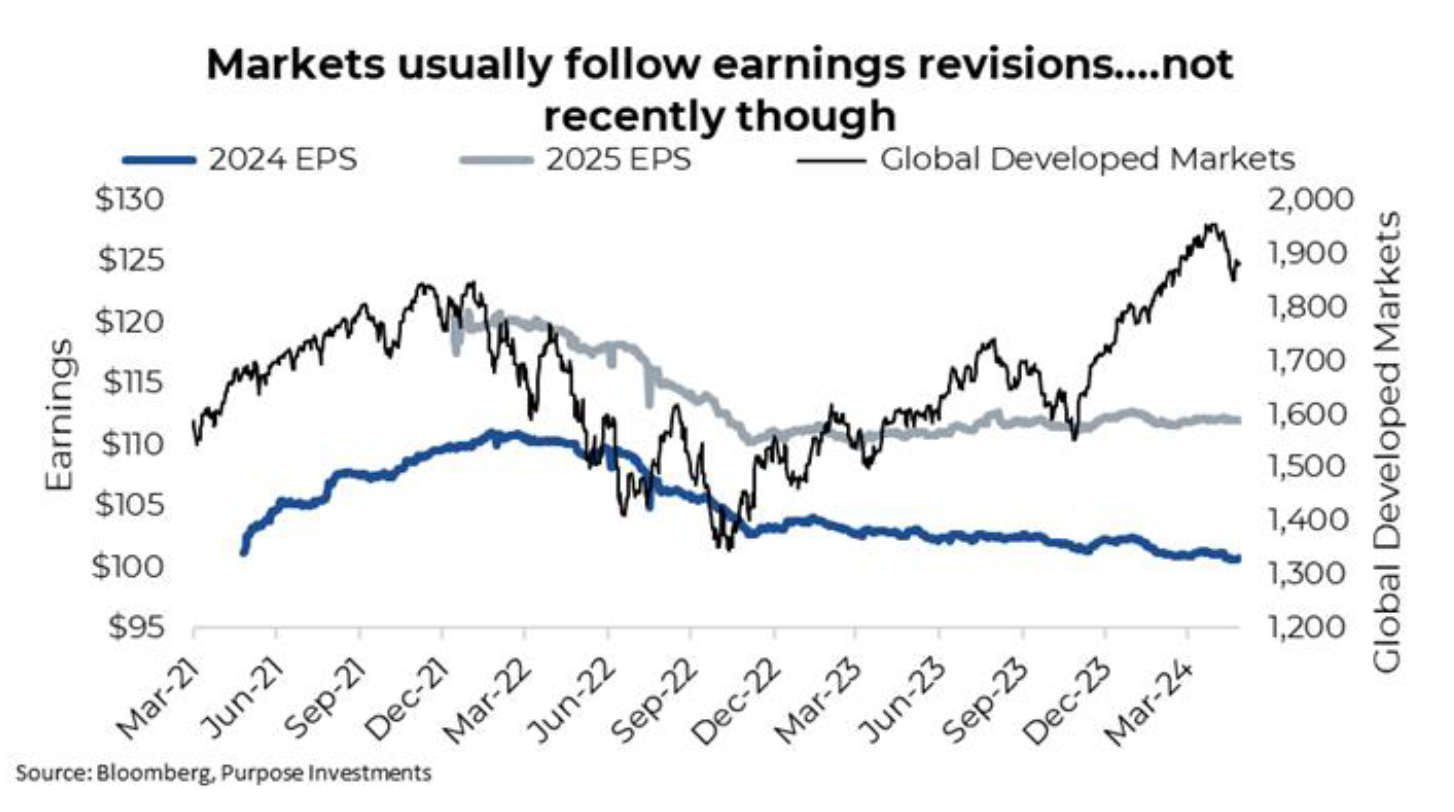

One of our reservations on the sustainability of this market rally over the past couple of quarters has been the flat earnings revisions. In other words, global markets are up over 20% but earnings estimates have remained flat or tilted down slightly. More often than not, markets trend in the same direction as earnings revisions. Earnings get revised up when companies raise guidance and/or analysts become more encouraged about growth prospects. That is a good thing for markets. Obviously, downward revisions are bad. Yet estimates have remained very flat as markets marched higher, a challenging combination.

And while this was a U.S. economic release, the impact has been global. In response, bond yields moved higher in the U.S., Canada, Europe, and elsewhere around the globe. The move is about 10-15bps at the time of writing, which has the U.S. 10-year at 3.17% and the Canada 10-year up even higher at 3.35%. Once again, that makes for a drop in equities and bonds, which is not something anyone likes. 10-year yields are now a decent amount over 3% and are at a pretty critical level.

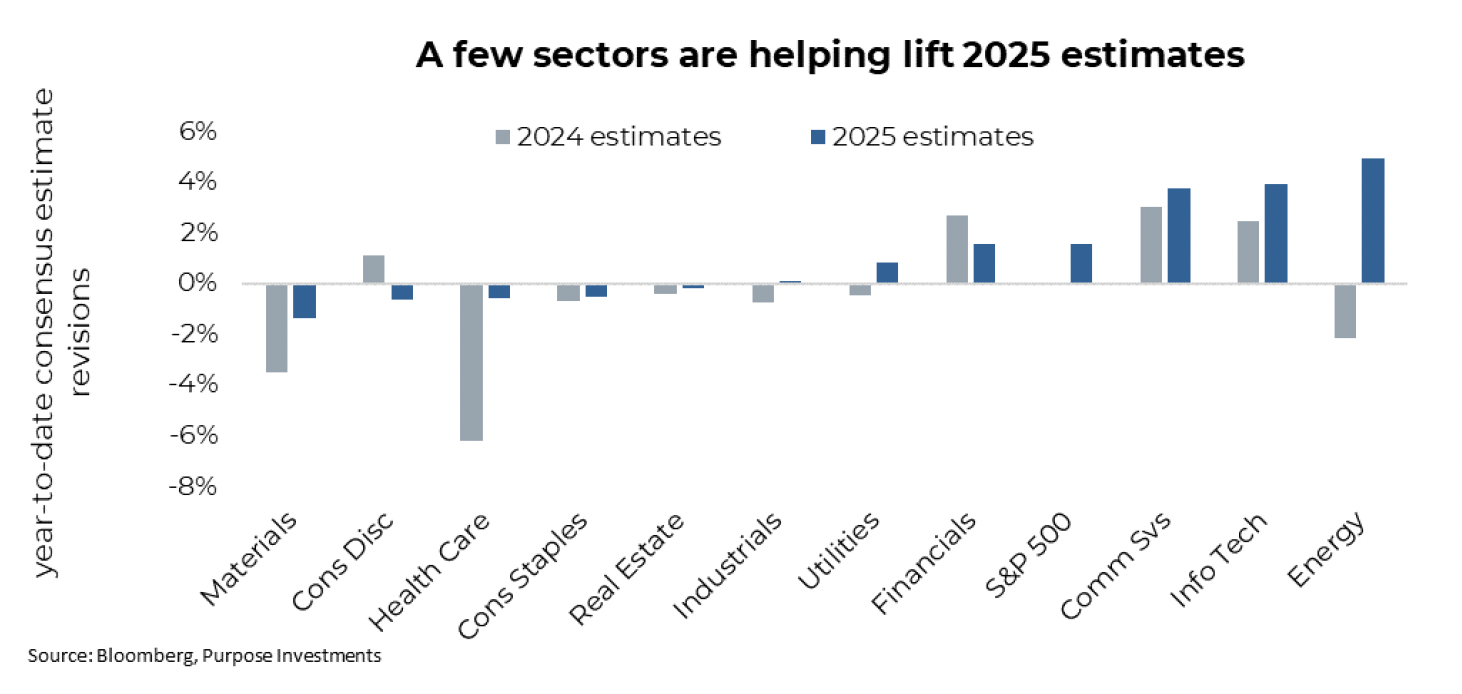

Given the importance of earnings, a good earnings season is a welcome boost to markets. The question is whether this good season will translate into rising revisions for forward estimates. So far, it has not. Global earnings from the earlier chart show 2024 still trending ever so slightly lower and 2025 more stable to ever so slightly higher. Looking at just the U.S. market, it is rather similar. 2024 earnings are forecast at $243, the same number as of January 1st. 2025 looks a bit better, with consensus estimates of $270 rising to $275 so far this year.

Digging down to the sector level, it seems just a couple of sectors, including Energy, Info Tech, and Communication Services, are lifting the overall market earnings. Energy makes sense as commodity prices have been trending higher, tech too, given the excitement spending around AI. Communication Services is an odd one on the surface but is mainly Alphabet. Traditional telcos are seeing estimates fall.

So where do earnings go next? There are some decent headwinds for U.S. earnings. One is a higher U.S. dollar, running a bit higher than last year. Given the amount of earnings that come from overseas, once translated back to USD, a strong dollar is a negative. The bigger drag may be interest expense. Last quarter, S&P 500 companies paid $68 billion in interest expenses, which is up from $59 billion a year ago. Variable interest obligations have already adjusted to the higher rate world, but the fixed-term obligations will only reset once they mature. In other words, even if yields/rates start to come down later this year, interest expenses will likely keep rising for many quarters to come.

Wages and other corporate input costs are also a negative for future earnings. On a positive note, wage pressures have been trending lower. The Atlanta Fed Wage Growth Tracker peaked at 6% in 2022 but has been steadily falling for over a year down to 4.7%. That is not bad, considering that historical norms were in the 3-4% range.

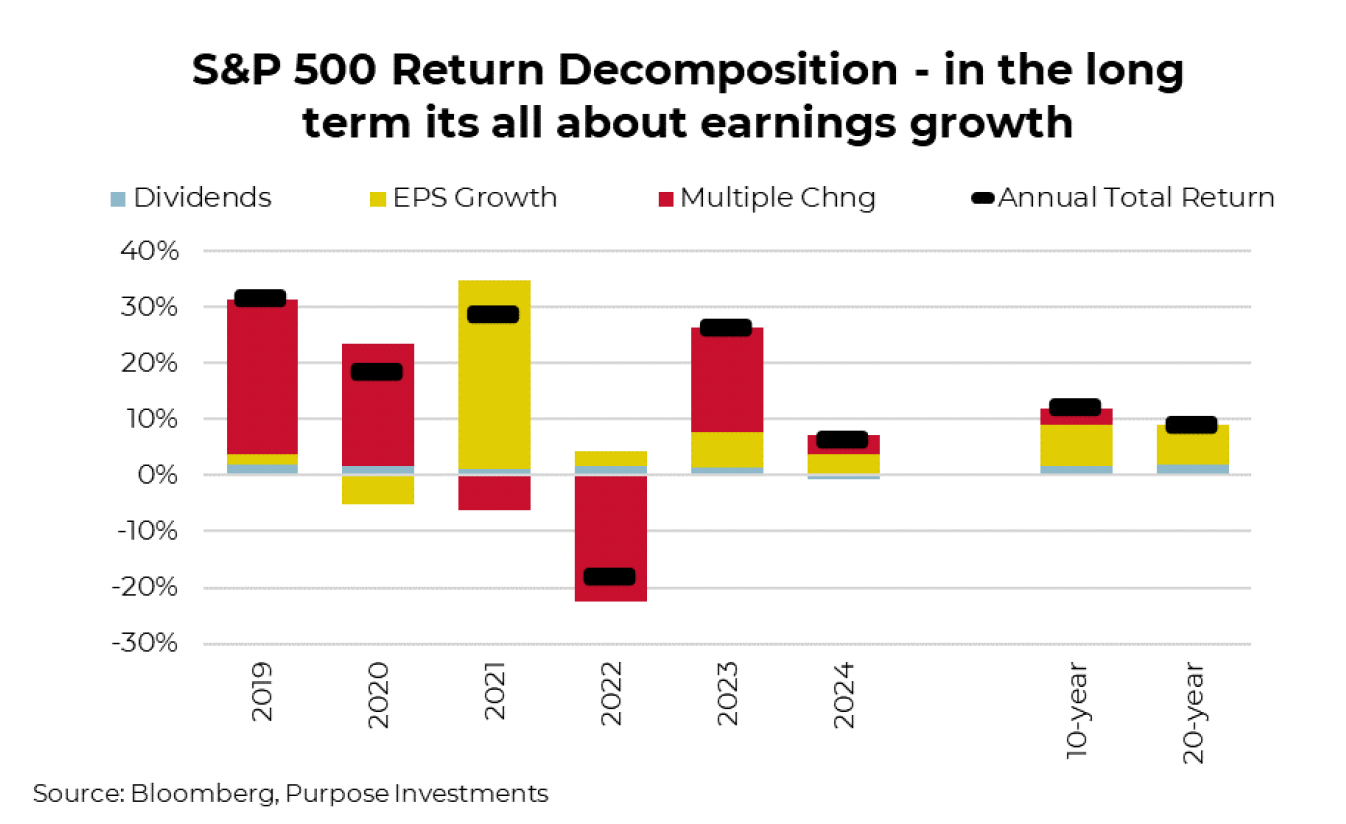

Despite these headwinds, there are some very positive factors as well. U.S. earnings tend to be highly correlated to manufacturing activity. S&P 500 year-over-year earnings growth tracks PMI (Purchasing Managers survey) with a six -month lead. Which means the uptick in PMI data we are seeing today bodes well for earnings growth in the coming months.

The economic data, globally, has been improving. This should result in further earnings growth and upward earnings revisions. The Citigroup economic surprise index for the world has been positive for most of 2024 so far. This means that economic data is coming in better than consensus estimates. And if you ask copper, with its honorary PhD in economics, maybe things are even heating up more so. Given how many areas of economic activity consume copper, its price moves are often a precursor for the move in the economy. Copper prices have recently risen through $4/lb, a level not seen since 2021/early 2022 as the economy emerged from the pandemic.

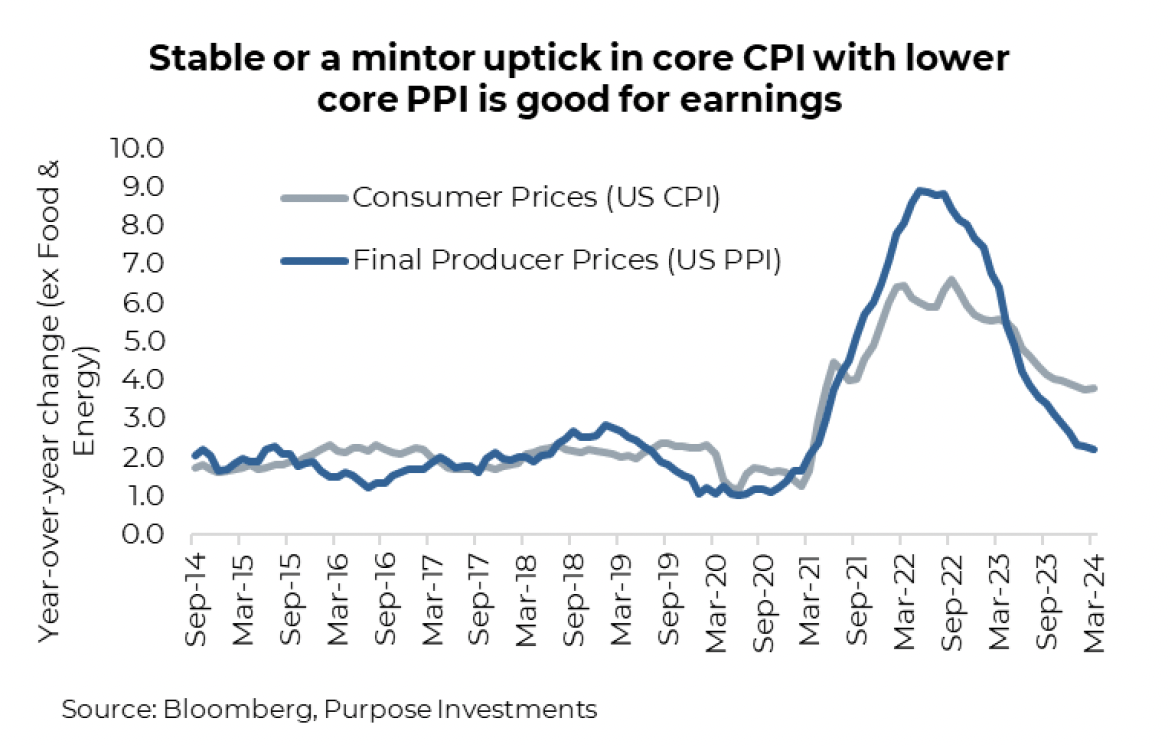

The final good news may be inflation. Inflation sucks; it is a tax on your future spending power or the value of your wealth. But for earnings, inflation is good. It means companies are able to raise prices, and when Producer Prices (PPI) are rising slower than Consumer Prices (CPI), that is an earnings-healthy combination.

Final Thoughts

Earnings probably have more going for them than against them these days, which is a good news story. Hard to say if it will be enough to maintain the gains of the past few quarters, but it certainly would be helpful. The U.S. earnings season is halfway through the Q1 season and it has been good. Hopefully this trend persists. And, hopefully, the Leaf’s playoff trend doesn’t.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Greg Taylor and Derek Benedet Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used herein under a non-exclusive license by Echelon Wealth Partners Inc. (“Echelon”) for information purposes only. The statements and statistics contained herein are based on material believed to be reliable but there is no guarantee they are accurate or complete. Particular investments or trading strategies should be evaluated relative to each individual's objectives in consultation with their Echelon representative.

Echelon Wealth Partners Ltd.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Ltd. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.

CLIENT LOGIN

L.I.F.E. Wealth Management Inc.

Please note that only

Echelon Wealth Partners

is a member of CIPF and regulated by IIROC;

Chevron Wealth Preservation Inc. is not.

*Insurance Products provided through Chevron Preservation Inc.

Website Links