Investor Strategy – 2022 Outlook – The Long Road Back to the New-Normal

The end of 2021 nears, and it was clearly a win for investors. Although the pandemic retains it grip on humanity, economies, companies, and behaviours have adapted relatively well, in aggregate. 2022 looks like it will be a more challenging year, as some trends are poised to change, which adds uncertainty. But, there is good news too, as the global economy appears to be expanding with solid momentum.

This year ahead outlook is a collaboration among the investment management team at Purpose Investments. A team that continues to expand in both numbers and breadth. In the report, you will find:

I. Market Recap – 2021 A Good Year with Many Market Surprises

II. Key Macro Trends for 2022

- The global tightening cycle has begun

- Economic growth continues to broaden

- Inflation risks remain persistent

III. Market Cycle & Portfolio Positioning

- Current market cycle

- Portfolio positioning

IV. Rising Trends in Asset Allocation

- Searching for alternative sources of diversification

- Positioning for continued energy transition

- Defending your long-term financial plans from inflation

2021 – A Good Year with Many Market Surprises

— Greg Taylor

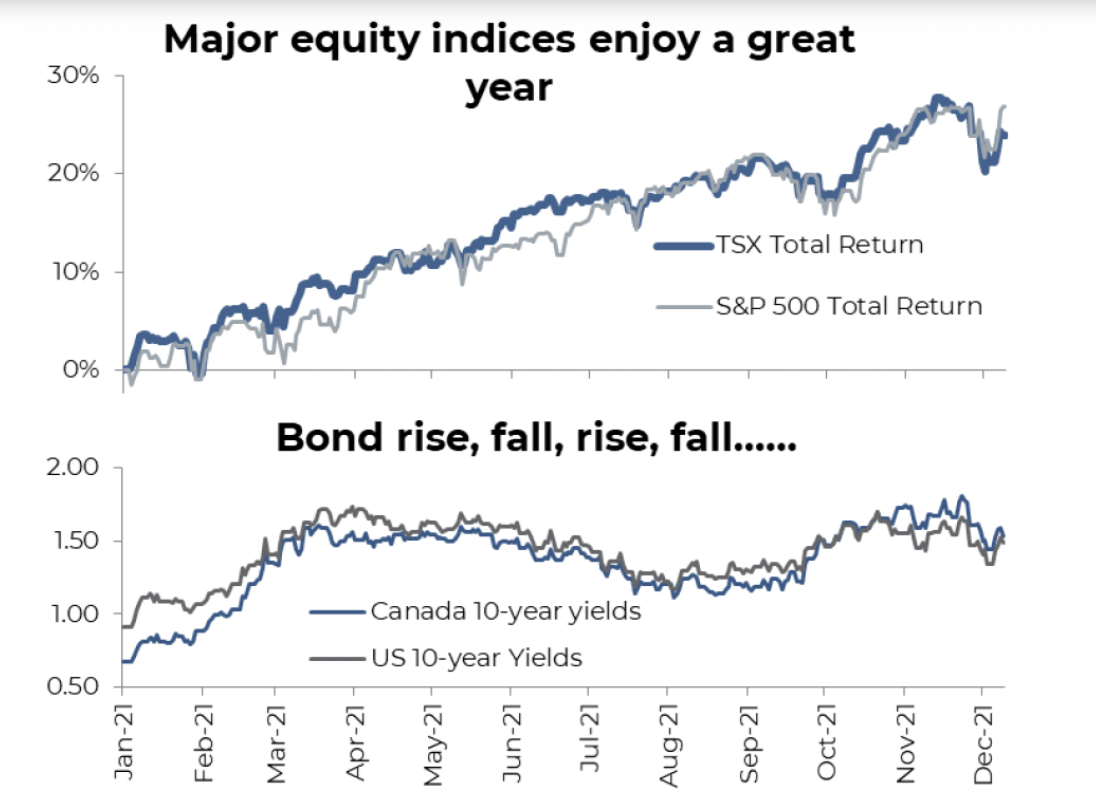

Looking back at a year where many equity indices were higher by 15% or more, you could assume that it was a rather dull year and easy to make money. However, that wasn’t the necessarily the case as many multi-year trends reversed, and we expect many more trends to be at risk of turning in the near term.

The year started with one of the strangest rallies in market history—the rally of the ‘broken’ meme stocks. In many cases, this trend was the result of the return of the retail investor, rediscovering the stock market and day trading during lockdown. Through tools such as the Robinhood trading platform, which gave access to options, leverage, and social media chat groups, these investors were able to cause massive moves in the most-shorted companies in the market. In the end, these share-price moves hurt many established hedge funds, which were on the wrong side of the new trend.

It wasn’t only the meme stocks that participated in this retail mania. Cryptocurrency joined the party too. And not just the usually suspects, like Bitcoin, this year DeFi tokens, coins like Ether, Solana, and even dogecoin, and non-fungible tokens (NFTs) all experienced a surge in popularity.

Like many historical rallies, looking back in a few years, we will shake our heads at some of these moves, but like the dot.com bubble, there will also be several winners that come out of this trend and go on to change the world. Could it be Ethereum? How Ether should fit into investor’s asset mix will be a fascinating debate over the years to come—it doesn’t seem like an asset class that investors can ignore going forward.

Outside of the more speculative pockets of the market, there were also strong returns in many traditional parts of the market, notably the cyclicals, in particular the energy stocks. This sector had been left for dead in the new ESG world, as investors assumed demand would fade away and the group would disappear. However,

those who ignored it missed the best performing group for the year.

As everyone was focused on other topics, this sector has been transforming itself to increasingly meet ESG demands, in many cases better than many other industries. The bad actors have faded away and the remaining companies cleaned up their operations and adapted to the new normal. At these commodity prices, these companies can return massive amounts of capital to shareholders.

The revenge of value stocks caught many off guard. As the market rally evolved from the immediate pandemic winners (Zoom, DocuSign, and Peloton) to real companies, the game is going to change. One of the lasting impacts of the pandemic is all the monetary/fiscal/cash that was thrown at the problem, and how that will move markets going forward. It is currently being felt in the inflation statistics. Inflation, whether transitory or not, has been a crunch on many sectors, acting as a benefit in some cases and a sneaky tax on consumers in others.

As much as the pandemic has dominated the market commentary over the last couple years, the most important factor for markets will always be the central banks. As the old-age adage goes, “Bull markets don’t die of old age—they are murdered by the Fed.” And it is a very real fear. As the pandemic fades away, it will be important for investors to prepare for a less market friendly Federal Open Market Committee (FOMC). In the near term, the risk will be if the Fed will be making a mistake and removing stimulus too soon or too quickly?

The fact that central banks are taking away stimulus and working to normalize interest rates is not necessarily the end of the bull market, but things will evolve. What investors need to prepare for is more volatility as pivots in central bank behaviour clearly inject greater uncertainty on the policy side. The end of a cycle is never an easy period for investors. Making sure to not just passively buying the market instead and actively managing risk will be more important than ever.

Since the pandemic emerged, equity markets have had a wild ride that has resulted in many all-time highs, but this isn’t a time to be complacent. Bond yields will follow inflation higher and will have a dramatic affect on which sectors will outperform. The long road to new normal will not be similar to the road in the rear view.

Key Macro Trends for 2022

— Craig Basinger & Derek Benedet

There is both good news and bad news as we look out to 2022. The global economy continues to grow at a very healthy pace. Valuations are not extreme in most markets. Given pent up demand and savings, the consumer is ready, albeit maybe less willing, depending on the path of the Omicron variant. Omicron has reminded investors that markets dislike uncertainty and that this pandemic still has the ability to inject uncertainty back into the minds of investors. We also are starting to see central banks step towards normalization, which is clearly justified given current inflationary pressures and the global economy’s recovery. But that is an economist speaking, the markets prefer more stimulus than less, so how markets react is the key.

In this section, we will share our views on three key trends we believe will be critical for the economy and markets in 2022, which include (1) the path and pace of central bank policies, (2) how the global economy continues to recover, and (3) the inflationary track including impacts on wages and margins.

The global tightening cycle has begun

Few would deny that central bankers have become the superheroes for the markets. Whenever the outlook turns ominous and it looks like things are falling apart, they show up just in time and inject a few billion (or trillion) of capital to help part the clouds and let the sunshine back onto the markets. Now with the economy on more solid footing, the trend among central banks has them taking their foot slowly off the monetary gas pedal.

Over the past three months, ten of the bigger central banks hiked their respective overnight rates. So far these hikes have been mainly among developing nations, but the bigger central banks are getting closer to following suit. Quantitative easing (QE) is also on the decline. The Bank of Canada ended QE a few months back, and others have slowed their bond buying. Of course, all eyes remain on the U.S. Fed’s plans as they have started to ‘taper’ bond purchases. Each incremental taper gets the market closer to rate hikes.

The market is currently pricing in 2 ½ rate hikes by the Fed in 2022, starting around mid year. The UK and Canada are forecast to move sooner, and the eurozone later. Any way you cut it, unless the economy or markets derail, the tightening cycle is upon us.

If history is our guide, which arguably is more concrete than simply hypothesising about the future, this isn’t a bad scenario. Focusing on the Fed, since they are the bigger driver of market reactions, the starting of a tightening cycle is not overly bad for markets, or even the bond market. Intuitively this does make sense. The Fed starts hiking when the market and economy are strong enough to remove accommodation or become more hawkish. Hopefully this will cool parts of the economy that may be overheating and give the central bank more flexibility should weakness arise down the road.

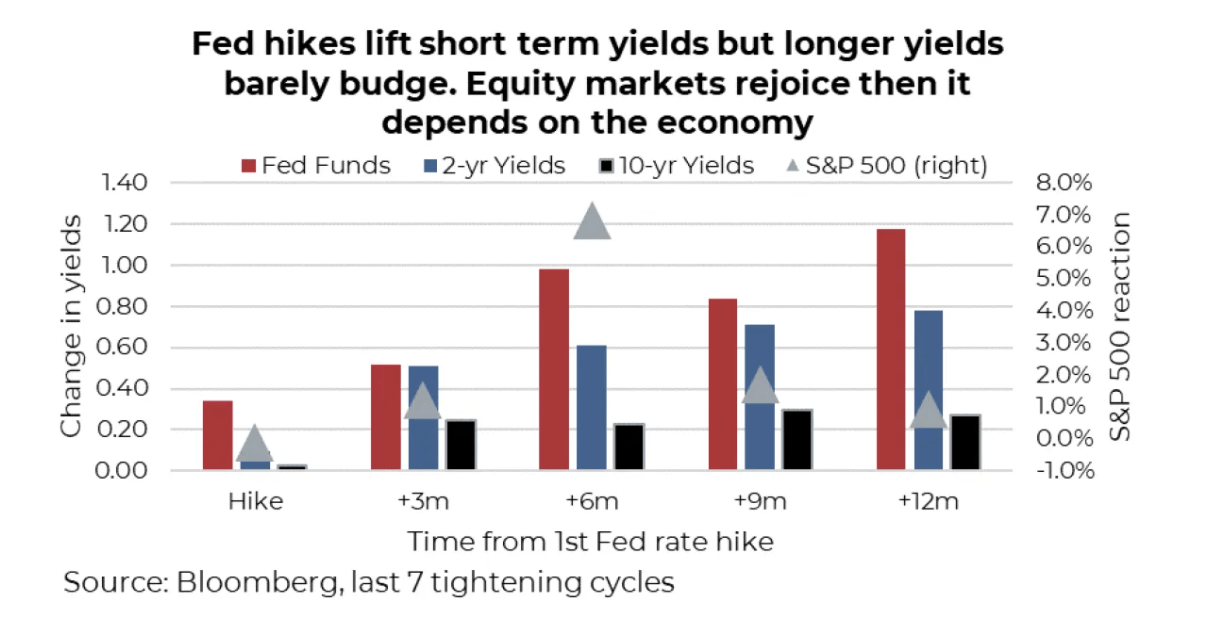

Looking at the market reaction to the last seven Fed tightening cycles, there is more good news than bad. Starting with bond yields, rising the overnight rate obviously puts upward pressure on shorter-term yields—that is simple math. However, for longer-term yields such as the 10-year, the reaction is very muted, and in just under half the scenarios (three or seven), the 10-year yield was lower six months later after the first-rate hike. The bond market is not stupid: yields usually move higher well in advance of the start of a hiking cycle. Note that the 10-year yield has moved up over the past few months even with added Omicron gyrations.

Turning to equities, the S&P 500 was higher six months later in all occasions. Sure, volatility rose as the market adjusted to the change in monetary policy but again with the Fed hiking because things are going better in the economy, equity markets are amendable. A year later, things are cloudier. If there is a recession looming after the hiking cycle starts (four of the seven), the equity outlook a year later is not good. If there is no pending recession, go bull go.

There are clearly risks to this gradual pending pivot in global monetary policy. On one hand, it is likely overdue given inflationary price pressures and how far the economy has recovered. However, asset prices have been inflated over the past year-and-a-half thanks to these monetary policies. This includes stock prices, bond prices, and house prices. The price sensitivity to tightening monetary policies may be higher than historical patterns.

2022 will be a monetary adjustment year as policy moves back towards normal. Given current economic strength, we don’t believe a recession is imminent, which has us believing this will simply add to market swings but not trigger a bear.

Economic growth continues to broaden

Looking out to the year ahead, the global growth outlook hinges on keeping the recovery on track. Global vaccination progress remains critical to reduce the virus’s impact on real gross domestic product (GDP) growth. Unfortunately, the situation with the virus remains very fluid. The emergence of Omicron presents a new twist, and admittedly with the science still playing catch up, it creates bit of a blind spot. Vaccine efficacy and the severity of the disease are two large unknows at present. It’s difficult to write a complete playbook for the year ahead; however, we venture that the economic risk from Omicron is relatively low and stress that each new wave has a more muted impact on economic activity.

The global economy will continue to rebound despite current headwinds in the form of supply chain bottleneck pressures and ongoing pandemic flareups. Mobility restrictions introduced in Europe and potentially other parts of the globe are damaging to growth but likely not comparable to last winter in terms of duration or strictness. Rather than focus on risks that we believe will continue to fade over the course of the year, investors should keep in mind the strong fundamental currents below these headwinds. The key fundaments remain as follows:

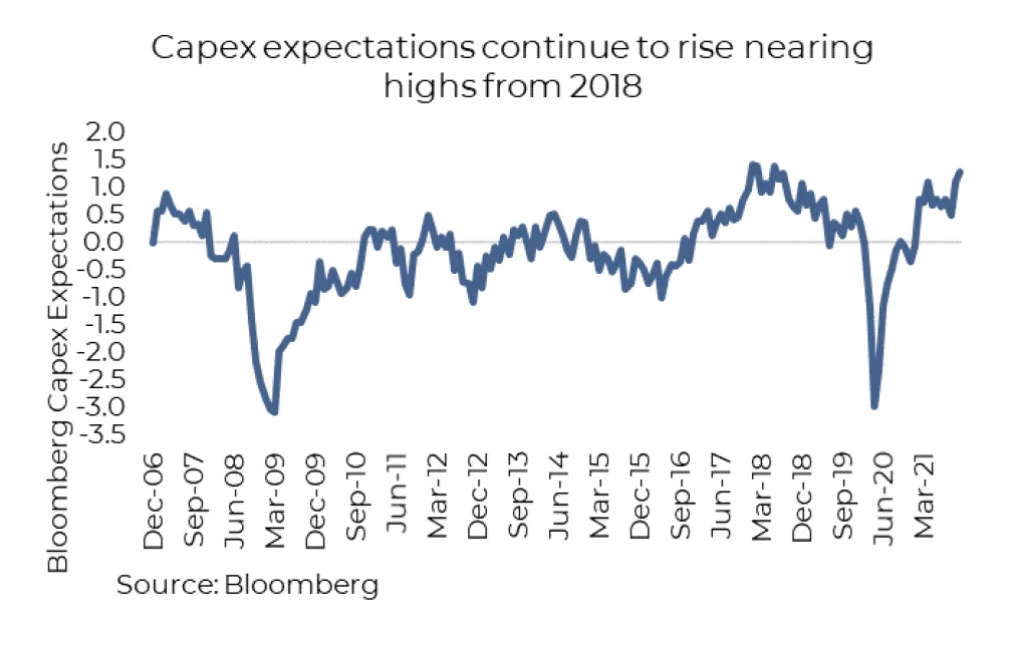

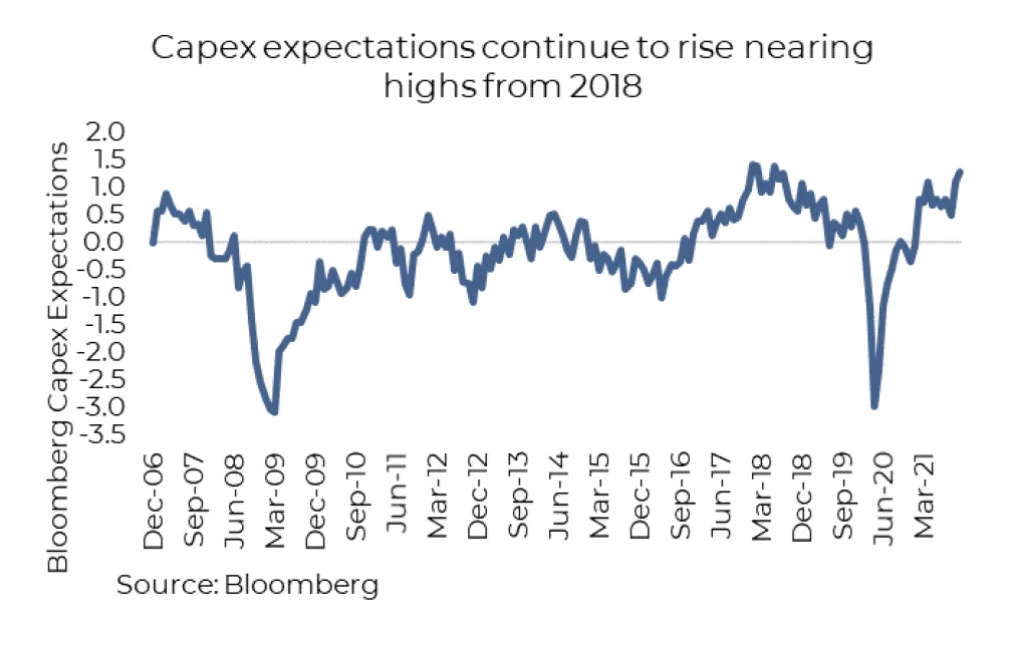

Healthy corporate balance sheets, with companies increasingly willing to invest to continue to grow their businesses. Capex expectations have all been very strong recently, a great precursor to broader growth.

- Excess savings, which has boosted household balance sheets over the course of the pandemic. Add on the wealth effect of surging home price values and this creates a very healthy environment for personal spending on goods as well as an expected shift to services over the coming year.

- Ongoing backdrop of

pent-up demand, especially for the service sector. As mobility restrictions ease globally, it makes sense to assume that services expenditure will occupy a more important role in shaping total spending. Growth expectations for services is now outpacing hard manufacturing goods, which we also expect to remain strong. Services expenditure is still lower than it was a year ago in the US, and overall remains low globally compared with pre-pandemic patterns.

- Accommodative policy both monetary and fiscal: Many central banks have already ended their extraordinary easing policies, and the Fed will soon begin to wind down, but it’s hard to argue that monetary policy will become overly restrictive. As seen in the chart below, financial conditions are considerably looser than historical averages and history would tell us it has only one way to go.

Inflation risks remain persistent

It is clearly very trendy to talk about the price of milk, gasoline, used cars or how the core consumer price index (CPI) is the highest since the early 1990s. We shouldn’t— it doesn’t really matter. True there are price gyrations going on driven by supply issues, robust return of aggregate demand, and changing spending patterns, but these will sort themselves out. After all, it is profitable for companies to solve supply bottlenecks, spending patterns are unlikely to continue to change in the same direction (are actually starting to reverse), and the best solution for high prices is high prices. This price spike does negatively affect the real value of your portfolio and other assets but given how markets and asset prices have risen over the past year, don’t expect too much sympathy. The big question is what happens next?

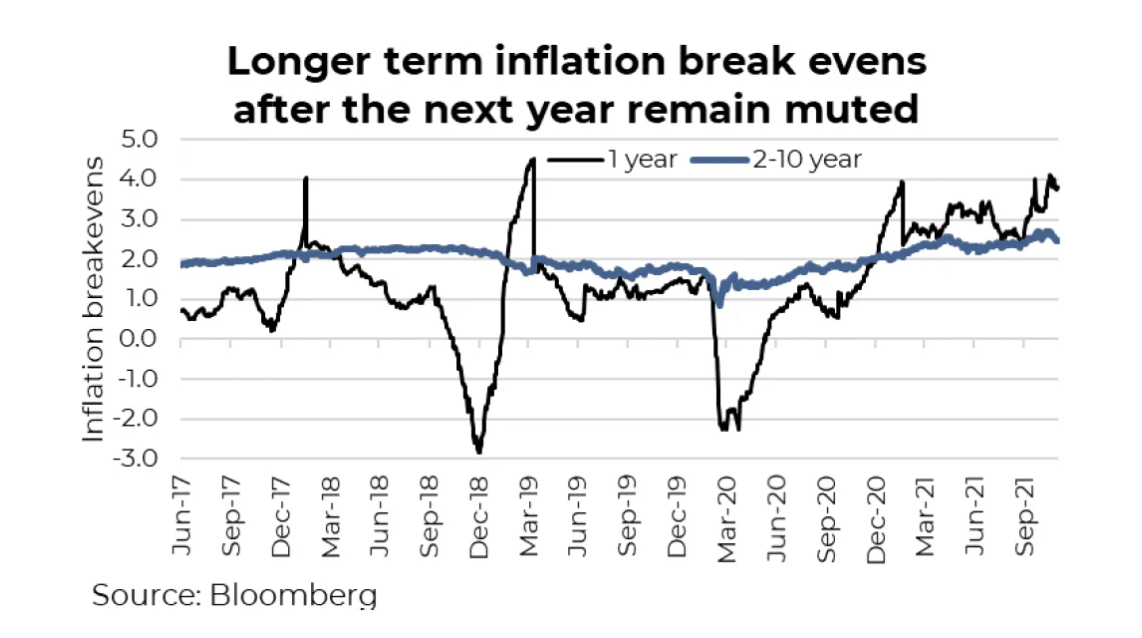

The short-term price gyrations will continue well into 2022, certainly making this a recurring topic. From a market perspective, we should care more about the longer-term inflation expectations, not that CPI is +4.6% compared with last year. It is these long-term inflation expectations that underpin bond yields, valuations, and discount rates on the price of just about anything. If these move, it has a big impact, much more so than paying an extra 75 cents for milk.

The good news is so far, longer-term inflation expectations have only marginally ticked higher. The following chart is the inflation break-evens being priced into the bond market. True, the one-year reading is elevated at nearly 4% but the implied inflation after the next year out to 2031 (2-10 year) remains muted. This is the market telling us that much of the rise of current prices is a short-term issue. This is the number that matters more for asset prices, from stocks to bonds to homes.

So, what happens after the short-term price spike? There are some very long-term forces on both sides. The amount of debt in the world remains a deflationary force, and wow is there a lot of debt now! Demographics, the gradual aging of the world population—especially in developed nations—remains a strong deflationary force. But some deflationary forces are diminishing. Globalization, essentially the relocation of manufacturing to lower labour jurisdictions, has been slowing and could slow even faster as companies/governments are rethinking their supply chains. Company mindsets around logistics and inventory appears to be changing from ‘just in time’ to ‘just in case.’ This may pass as the pandemic fades, but if this is a new trend, it is inflationary (or at least a deflationary force is softening).

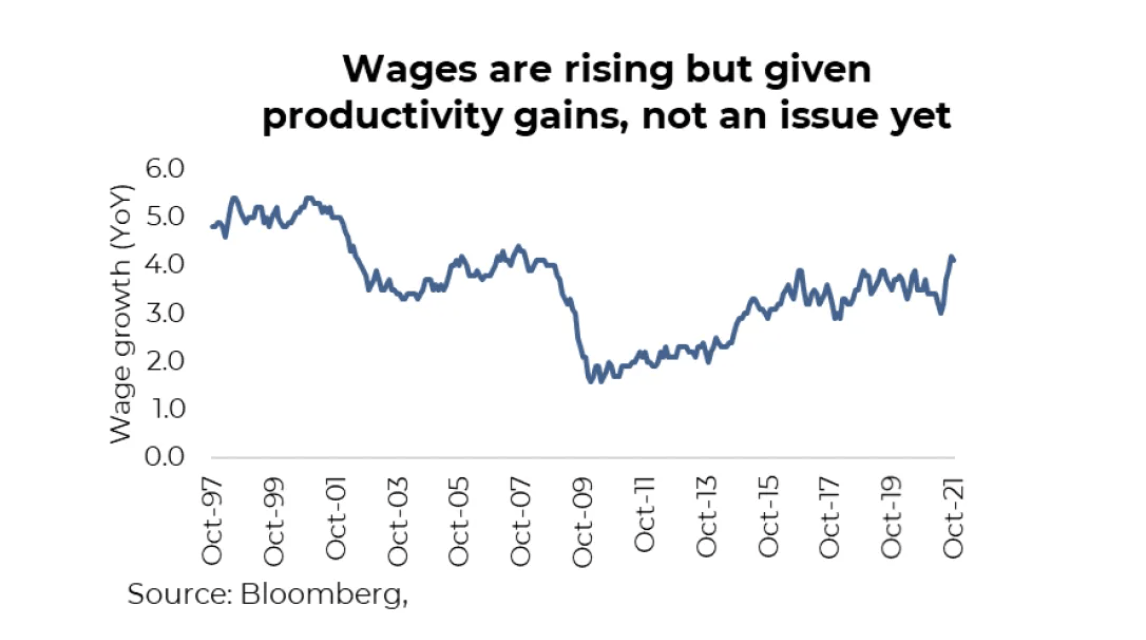

While we expect the CPI inflation impulse to fade in 2022, given how long it is lasting, it is starting to drag longer-term expectations higher. The policy impact has likely not flowed through the system, as it hit bottlenecks from higher savings to lack of goods to buy to inability to spend on some activities during this pandemic, which supports higher inflation expectations going forward and is starting to translate into higher wages.

This isn’t the 1970s (i.e., higher prices with falling productivity) nor is it the late 1940s (i.e., higher prices driven by rebuilding the world). But the inflationary trend is to the upside, and this has implications from financial plans, corporate behaviour on debt and buybacks, value vs growth, yields and valuations. We believe investors should have an inflation protection tilt to their portfolios and consider the impacts of gradually rising longer-term inflation on all investments.

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Greg Taylor and Derek Benedet Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used herein under a non-exclusive license by Echelon Wealth Partners Inc. (“Echelon”) for information purposes only. The statements and statistics contained herein are based on material believed to be reliable but there is no guarantee they are accurate or complete. Particular investments or trading strategies should be evaluated relative to each individual's objectives in consultation with their Echelon representative.

Echelon Wealth Partners Ltd.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Ltd. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.

CLIENT LOGIN

L.I.F.E. Wealth Management Inc.

Please note that only Ventum Financial Corp.

is a member of CIPF and regulated by IIROC;

Ventum Insurance Services

is not.

*Insurance Products provided through Ventum Insurance Services.

Website Links